We’re excited about the future of artificial intelligence (AI) in the workplace and aren’t waiting around for others to lead the way. Instead of choosing ready-made tech solutions, we believe in a build vs. buy approach and create our own AI tools at UWM. By developing our own technologies, we’re not just keeping up; we’re setting the pace in the mortgage industry. Let’s explore some of our AI innovations and how they’re elevating our game.

The Role Of AI In Modern Businesses

Companies are using AI to get things done faster and provide better service by automating tasks or crunching large amounts of data. As exciting as these changes are, they also raise the concern of AI taking over jobs. It’s important to acknowledge that while AI can replace jobs, it can also create opportunities and improve existing roles. At UWM, we see AI as a powerful tool to support our workforce, not replace it. By embracing machine learning and artificial intelligence, team members can learn new skills, complete their tasks faster and more efficiently and potentially even take on roles that didn’t exist before. This integration of technology not only helps our team members grow in their careers but also ensures that everyone benefits.

AI Tools and Technology at UWM

At UWM, our proprietary tools like ChatUWM and BOLT demonstrate how we’re leveraging AI innovation to support our clients and team members and improve the overall mortgage experience for borrowers across the country.

ChatUWM

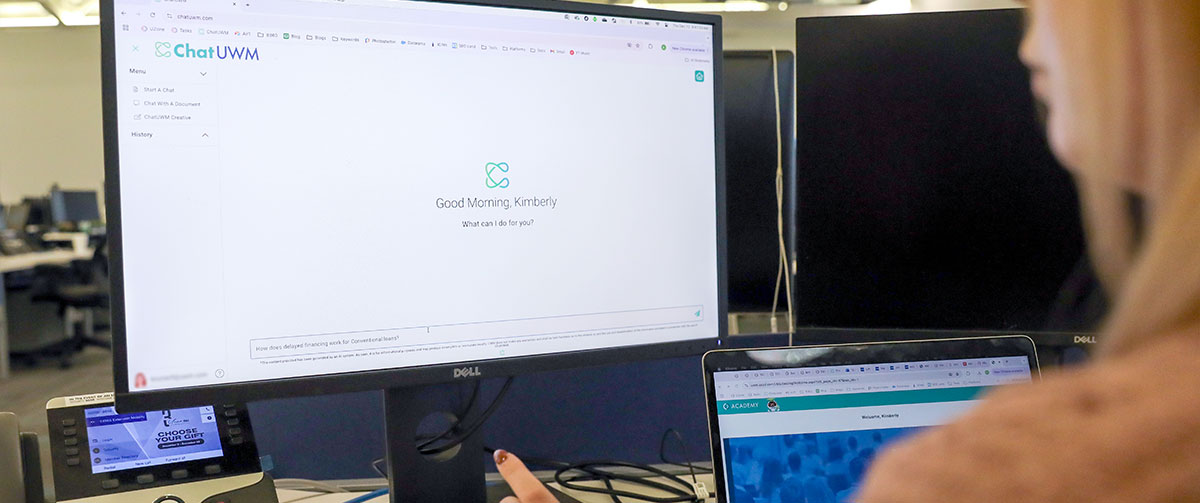

ChatUWM is an advanced AI-powered technology designed specifically for UWM. It helps brokers and team members reduce manual, repetitive and time-intensive tasks from paperwork to guidelines and processes. ChatUWM’s advanced language modeling and data validation allows it to understand and process text better, while also checking that the information entered is correct and complete.

Clients and team members can upload PDFs and interact with the documents, while ChatUWM automatically pulls information from them, reducing mistakes that can happen when manually entering data. It makes it easy to find, summarize and validate data and can answer common questions for both our clients and team members.

Our commitment to innovation and the impact of our AI development has not gone unnoticed, as ChatUWM received the honor of being named one of HousingWire's Tech100 Award winners for companies and solutions that revolutionize the mortgage process.

BOLT

In 2021, UWM launched a proprietary technology that cleared the path for a record number of loan approvals and helped borrowers get to the closing table faster than ever before. The Best Origination Loan Tool, or BOLT, is a self-service mortgage underwriting platform that provides independent mortgage brokers with the ability to get an initial approval for qualified borrowers in as little as 15 minutes, as opposed to hours. As we introduced AI into our BOLT technology, the tool became even faster, allowing underwriters to approve up to 14 loans a day, compared to just 6 loans before — more than doubling their volume.

We’re not only using AI to improve our operations and support our team members, but we’re also leading the way in the industry. By integrating our advanced AI innovations, we break down barriers and create a one-stop shop where brokers can easily access everything from UWM policies to training resources. And this is just the start.

At UWM, you can expect to be part of a forward-thinking team that values technology as a tool to enhance our team members’ roles and support their growth. See for yourself and become part of our team!

Apply now